tax preparation fees 2020 deduction

Only the self-employed can claim a deduction for tax preparation fees in tax years 2018 through 2025 if Congress does not renew legislation from the TCJA. In order to meet this you have to fit the folowing criteria.

The Master List Of Small Business Tax Write Offs For 2020 Owllytics Small Business Tax Business Tax Business Tax Deductions

Since 112018 tax return prep fees.

. It was obvious the preparer wasnt sure where to put it on Schedule A Itemized Deductions and so he had put it on the wrong line and attempted to override the program. Deducting Business Tax Preparation Fees. Form 1040 with Schedule A and state return.

We cannot approve deductions taken on the Combined Excise Tax Return that are not itemized on pages. If you take the standard deduction you will not be able to deduct any portion of your personal tax preparation fees however you will still be able to deduct the full cost of your business. February 27 2020 1 Min Read.

Theres a reason why you couldnt input it on the form. However the big question is how do you write off your tax preparation fees. They also include any fee you paid for electronic filing of.

Dont spend a lot of time hunting around for the right place to enter them. According to a National Society of Accountants survey in 2020 on average you would have paid 323 if you itemized your deductions on your tax return. Who Can Still Deduct Tax Preparation Fees.

Prior to 2018 taxpayers who werent self-employed were allowed to claim. This means that if you own a business as a sole proprietor you are eligible for this deduction and can claim it. On the other hand individuals who are self-employed are able to deduct the cost of the tax preparation fees including tax software or working with a professional.

Accounting fees and the cost of tax prep software are only tax-deductible in a few situations. Unless youre self-employed tax preparation fees are no longer deductible in tax years 2018 through 2025 due to the Tax Cuts and Jobs Act TCJA that Congress signed into law on December 22 2017. I recently saw a tax return for 2020 that showed the tax return deduction.

Medical expenses are tax deductible but only to the extent by which they exceed 10 of the taxpayers adjusted gross income. For example on your 2021 tax return you deduct the fees you paid to prepare your 2020 taxes. Washington State Department of Revenue PO Box 47464 Olympia WA 98504-7464 MAIL TO.

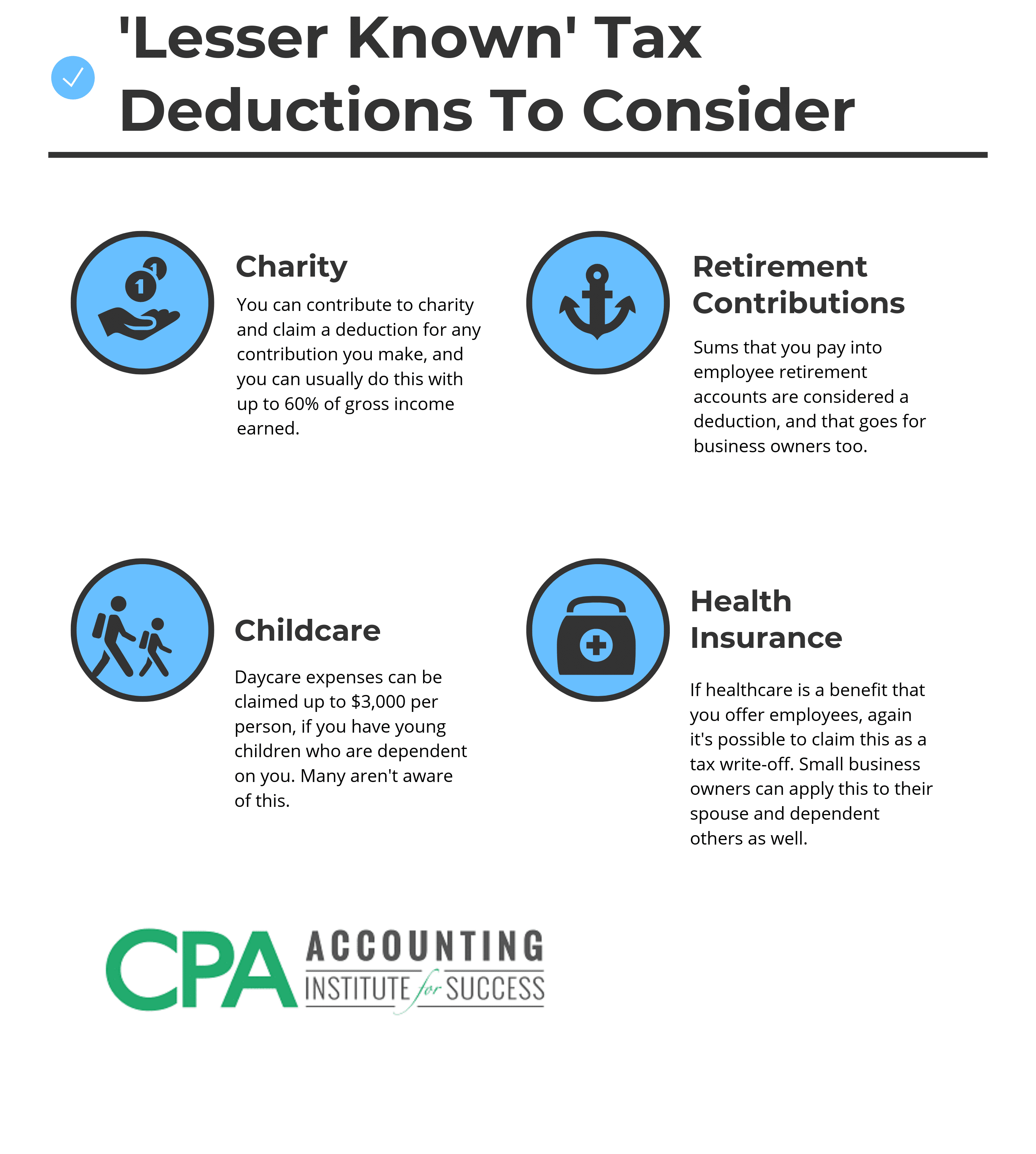

I recently saw a tax return for 2020 that showed the tax return deduction. If youre looking for some extra tax relief you may be wondering if the cost of preparing your tax return is deductible. While tax preparation fees cant be deducted for personal taxes they are considered an ordinary and necessary expense for business owners.

Self-employed taxpayers can still write off their tax prep fees as a business expense. Form 1040 non-itemized with state return. Unless youre self-employed tax preparation fees are no longer deductible in tax years 2018 through 2025 due to the Tax Cuts and Jobs Act TCJA that Congress signed into law on December 22 2017.

Tax preparation fees on the return for the year in which you pay them are a miscellaneous itemized deduction and can no longer be deducted. You can deduct the full cost of your business tax preparation fees on your Schedule C and a portion of your personal tax preparation costs on your Schedule A subject to limitation. You could go the diy route with tax preparation software or take the less stressful route and work with a cpa firm in raleigh.

File W 100 Confidence Online. In Budget 2020 to provide additional flexibility to taxpayers it was proposed that the tax deduction limit for secretarial and tax filing fees be combined such that a total deduction of up to RM15000 per YA be allowed for both expenses from YA 2020 onwards see Special Tax Alert. Average Tax Preparation Fees.

MINIMUM CHARGES FOR TAX PREPARATION Minimum Per Return Federal 1 State 650 1040 with Business Return Schedule C SE 750 Partnership Returns 1750 Corporation Fiduciary Returns 1750 Bookkeeping or record reconstruction for Tax Preparation during the months of January thru April per hour 260. The Tax Cuts and Jobs Act lowered. Before you gulp you can take some comfort in knowing that this generally includes both your state and federal returns.

The fee is usually a flat rate that applies to each schedule or form. Highlights of Budget 2020. Deducting medical expenses in 2020.

February 2020 02 Combined Excise Tax Return Deduction Detail 20 If you have deductions return pages 3 and 4If you do not have deductions do not return pages 3 and 4. You can deduct the turbo tax cost or any tax preparation fees you actually paid in on your. Meet With A Live Tax Expert From The Comfort Of Your Home.

For a breakdown on the average cost of filing common forms check out the following from the National Society of Accountants. Thanks to the Tax Cuts and Jobs Act of 2017 TCJA most investment-related expenses are no longer deductible. June 2020 06 Combined Excise Tax Return Deduction Detail 20 If you have deductions return pages 3 and 4If you do not have deductions do not return pages 3 and 4.

This means that if you are self-employed you can deduct your tax preparation fees under your business expenses at least through the year 2025 if Congress. These fees include the cost of tax preparation software programs and tax publications. Washington State Department of Revenue PO Box 47464 Olympia WA 98504-7464 MAIL TO.

The cost of your tax preparation fees is deducted like a business expense deduction. For most Canadian taxpayers the answer unfortunately is no. Can you deduct tax preparation fees in 2020.

We cannot approve deductions taken on the Combined Excise Tax Return that are not itemized on pages 3 and 4. Ad Skip The Tax Store And Get Live Online Tax Help From A TurboTax Live Expert. According to the National Society of Accountants the average fee in 2020 for preparing Form 1040 with Schedule A to itemize personal deductions along with a state income tax return was a flat.

A sole proprietor or independent contractor who files a schedule C with your return. However you can deduct some of the cost and other expenses from your gross income to lower your tax bill. If you have investments you may be wondering where you can deduct investment fees on your income tax return.

Deducting Tax Preparation Fees as a Business Expense.

Hsa Tax Deduction Rules H R Block

Midyear Tax Checklist To Maximize Your Tax Deductions Tax Checklist Tax Deductions Deduction

Small Business Tax Spreadsheet Business Worksheet Business Tax Deductions Business Expense

Home Office Tax Deductions See If You Qualify Tax Deductions Deduction Small Business Success

The Ultimate List Of Tax Deductions For Online Sellers Tax Deductions Small Business Tax Deductions Small Business Tax

Alternative Personal Income Tax Regime Finds Few Takers Mint

Restaurant Taxes 8 Essential Tax Tips Deductions For Restaurants In 2020 Deduction Tax Preparation Tax Preparation Services

Income Tax Deductions Fy 2019 2020 Tax Deductions List Income Tax Income Tax Preparation

Small Business Tax Deductions For 2022 Llc S Corp Write Offs

Tax Preparation Checklist Tax 2021 Mbafas

Difference Between Standard Deduction And Itemized Deduction H R Block

Small Business Tax Deductions For 2022 Llc S Corp Write Offs

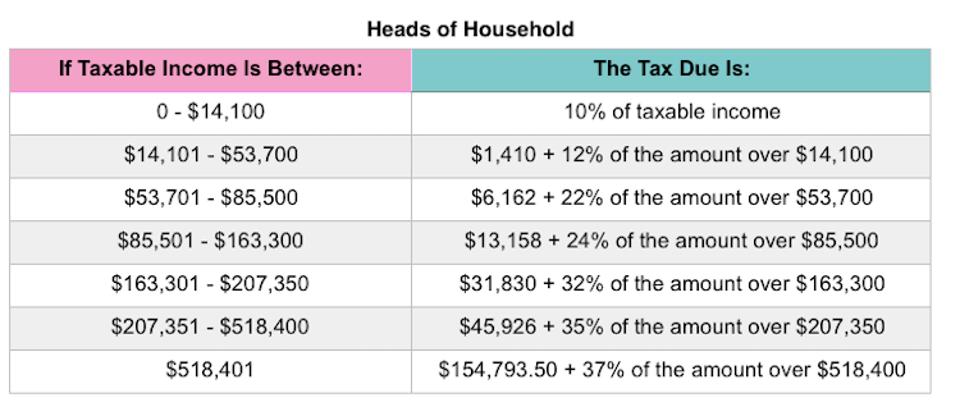

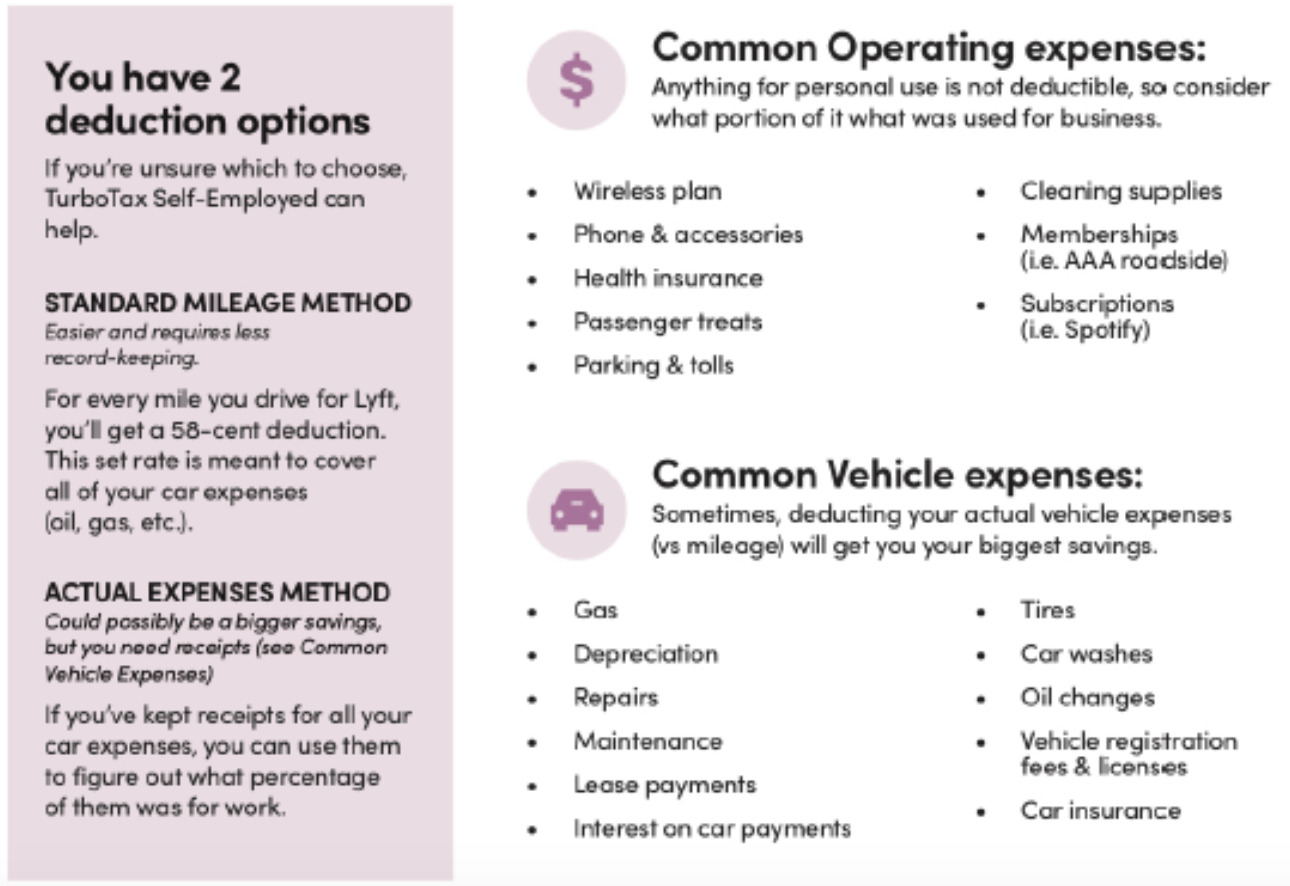

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help Income Tax Income Tax

Tax Tip 6 Tax Deductions Owe Taxes Tips

Business Bookkeeping Tracking Your Expenses And Income In 2021 Business Tax Deductions Tax Deductions Small Business Tax

Small Business Tax Deductions For 2022 Llc S Corp Write Offs